Market Correlation: How Different Assets Relate

Market correlation: understanding the complex cryptocurrency ratio

The cryptocurrency world has exploded in recent years and prices have risen rapidly and declined rapidly. While some investors attract the perceived high phrases and speculative nature of cryptocurrencies, others are more cautious, believing that the market is essentially unstable. One of the areas where the cryptocurrency market was particularly fascinating is the concept of market correlation – how different assets are related to each other in terms of price changes.

What is a market correlation?

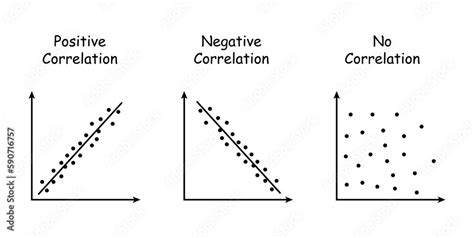

Market correlation indicates how much two or more assets are moving along with changes throughout the market. In other words, it measures how strictly the prices of two or more cryptocurrencies are combined. This concept is very important as it helps investors understand the mutual relationship between various assets and make conscious decisions.

Why is market correlation important?

Market correlation is important for several reasons:

- Risk Management : Understanding how different assets are related to each other can help investors identify possible correlations that can increase their risk. By recognizing this relationship, investors can apply their strategies to reduce losses and increase profits.

- Having established a connection between assets, traders can create more effective strategies that use market inefficiency.

- Analyzing the connection of various assets, these investors can optimize their risk profiles and achieve long -term goals.

Cryptocurrency Market: A Great Example

The cryptocurrency market is often mentioned as a great example of market correlation. Prices of various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) have historically corrected with each other. This relationship is determined by several factors:

- Guesses : Many investors buy cryptocurrencies for speculation, hoping to benefit from price changes in the future. When prices rise, these investors are more likely to sell their coins at peak times, which reduces prices.

- Additional Property : Some Cryptocurrency Market assets, such as Altcoins and Stablecouins, may show additional connections. For example, Bitcoin (BTC) often combines well with Ethereum (ETH), while others like Litecoin (LTC) tend to market better.

- Market mood

: Market moods can also affect cryptocurrency connection. When investors are optimistic about the future of the cryptographic market, they can risk and buy more assets, leading to increased correlations.

Examples of correlated property

Several examples illustrate the concept of a correlated property in the cryptocurrency market:

1

- Litecoin (LTC) and Bitcoin (BTC) : As an alternative to Bitcoin, Litecoin often achieved good results when prices are low or falling because investors slow down the market.

- RIPPLE (XRP) and Bitcoin (BTC) : Ripple price was correlated with bitcoins, especially with high variability.

program

Market correlation is a powerful tool to understand complex relationships between various cryptocurrencies.