Liquidation Events: How To Avoid Them

Cryptocurrency liquidity and market volatility: Understanding the risks of liquidation events

The world of cryptocurrencies has grown. As with every high risk market, however, there is also risks with investing in cryptocurrency. One of the most important concerns is the risk of liquidation events that can lead to significant losses for investors.

** What are liquidity events?

Cryptocurrency or asset decreases significantly, which means that the price drops significantly. This means that some investors have taken their funds from the market when liquidation events occur, which leads to a sudden decline in demand.

Causes of liquidity events

There are several reasons why liquidity events can occur in the cryptocurrency area. Some of these causes are:

* oversaturation :

. This can lead to sudden changes in demand and offer.

.

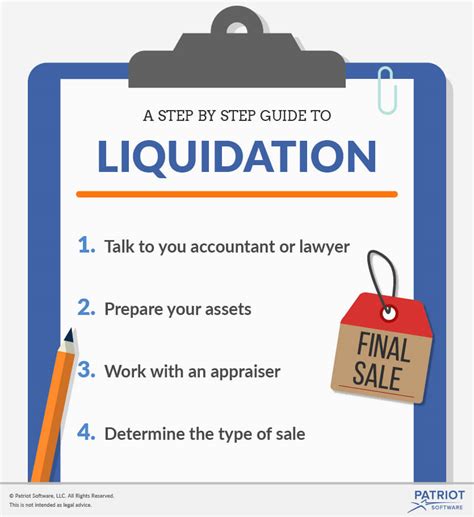

How to avoid liquidity events

Liquidity events, there are some steps that you can take to minimize your risk:

1.

- diversify your portfolio

:

- Set clear investment goals

: Define your investment steals and your risk tolerance before entering the market.

- Use stop-loss orders : Set stop-loss orders to limit potential losses

.

Best practices for investing in cryptocurrency

If you do that

- Use serious exchange : Select serious exchange and containers to store your cryptocurrencies.

.

- diversify your portfolio :

- Set clear investment goals : Define your investment goals and risk tolerance before entering the market.

- ** Use risk management

Diploma

Cryptocurrency liquidity events can be a considerable risk for investors, but to the diversification of your portfolio in order to reduce exposure to a single asset.