The Importance Of Economic Indicators In Trading Bitcoin (BTC)

The importance of economic indicators for trade Bitcoin (BTC) **

In the world of cryptocurrency trade, Bitcoin (BTC) is one of the most frequently traded assets on online exchanges. In view of the constant fluctuation of its price, dealers must be aware of various economic indicators in order to make sound decisions and increase their chances of success. In this article we will examine the importance of economic indicators for trade Bitcoin and offer you a comprehensive guide for use.

What are economic indicators?

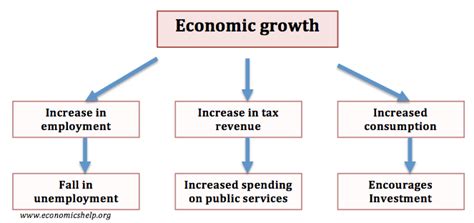

Economic indicators are statistical measures that describe the general health of an economy or market. They provide insights into factors such as inflation rate, interest rates, employment rates, GDP growth and more. In the context of the cryptocurrency trade, economic indicators are used to measure the mood of the market, predict price movements and to identify potential trend reversations.

Why are economic indicators important for trading Bitcoin?

Dealers who use Bitcoin for investment purposes must take a number of economic indicators into account if they make their decisions. Here are some reasons why:

- Seibiment analysis : Economic indicators can show the general mood of the market, e.g. B. whether investors are optimistic or pessimistic about the future prospects of Bitcoin.

- Trend identification : By analyzing economic indicators, retailers can identify trends on the market and predict potential price movements.

- Risk management : Understanding the underlying economic factors can help retailers to manage the risk by determining potential reversal or corrections on the market.

- Prediction model

: Economic indicators can be used to create predictive models that predict future prices for Bitcoin.

Important economic indicators for trading Bitcoin

Here are some important economic indicators that dealers use Bitcoin when trading:

- Inflation rate : The inflation rate measures the rate to which the prices for goods and services increase.

* Low inflation (less than 2%): stable market, low volatility

* High inflation (more than 5%): volatile market, potential for price correction

- Interest rates : The interest rates affect the credit costs that can affect the demand and price of Bitcoin.

* Lower interest rates: higher demand, higher prices

* Higher interest rates: lower demand, lower prices

- Employment rate : The employment rate measures the number of jobs created in an economy.

* Strong employment rate: optimistic market mood

* Weak employment rate: pessimistic market mood

- GDP growth : GDP growth measures the rate with which the economy of a country is expanding.

* Strong GDP growth: increase in demand for Bitcoin, increase in prices

* Weak GDP growth: reduction in demand for Bitcoin, falling prices

How to use economic indicators when trading Bitcoin

To start using Bitcoin trade indicators:

- Select the right indicator

: Select an economic indicator that matches your trade strategy and risk management approach.

- Register the economic data regularly : Follow the economic data regularly, such as: B. weekly or monthly reports from government agencies and central banks.

- Use technical analysis tools : Use technical analysis tools such as diagrams and indicators to identify trends and patterns on the market.

- Combine with basic analysis : Use economic indicators in connection with basic analysis such as news and social media in order to form a more comprehensive view of the market.

Diploma

In summary, economic indicators play a crucial role in trade Bitcoin (BTC). By understanding these key indicators and the effective use, retailers can make well -founded decisions and increase their chances of success.